For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and. EPF Dividend Rate.

Reduction In Epf Contribution Could Pose As A Risk In The Long Run Business Standard News

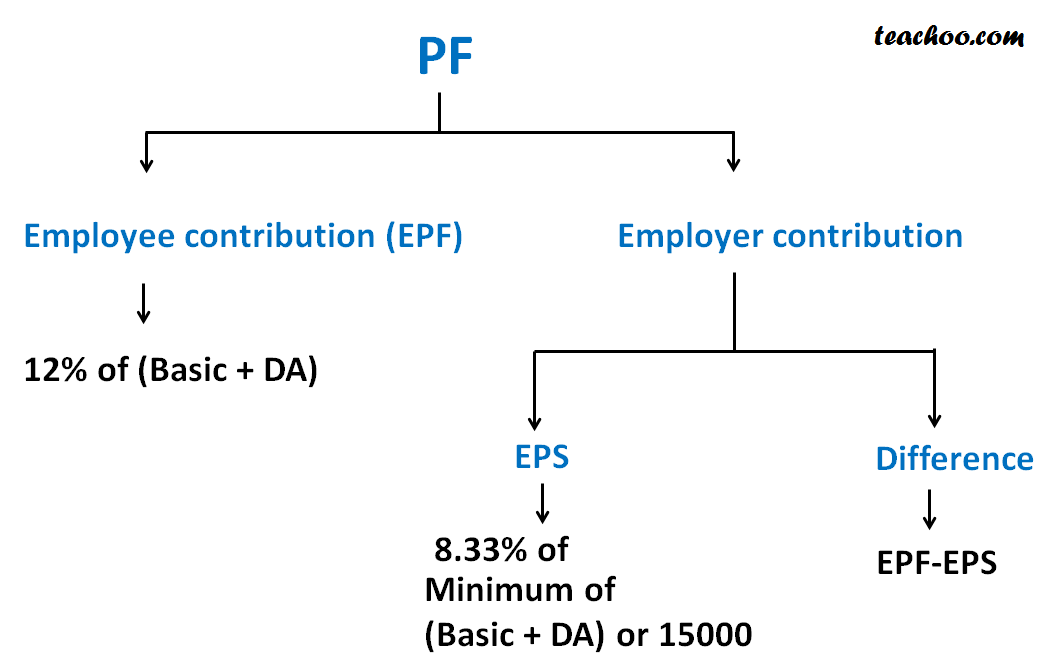

Contribution by an employer -The contribution made by the employer is 12 of the basic salary of the employee.

. EPFO on March 4th 2021 announced the EPF rate of interest at 850 keeping it the same as of the previous year 2019-20. Can an employee opt out from the Schemes under EPF Act. Since 2020 the default.

Contribution by the retail traders shopkeepers and self-employed persons. The dividend rate of the EPF is always higher than Fixed Deposit Rate provided by bank. About Employees Provident Fund Organisation.

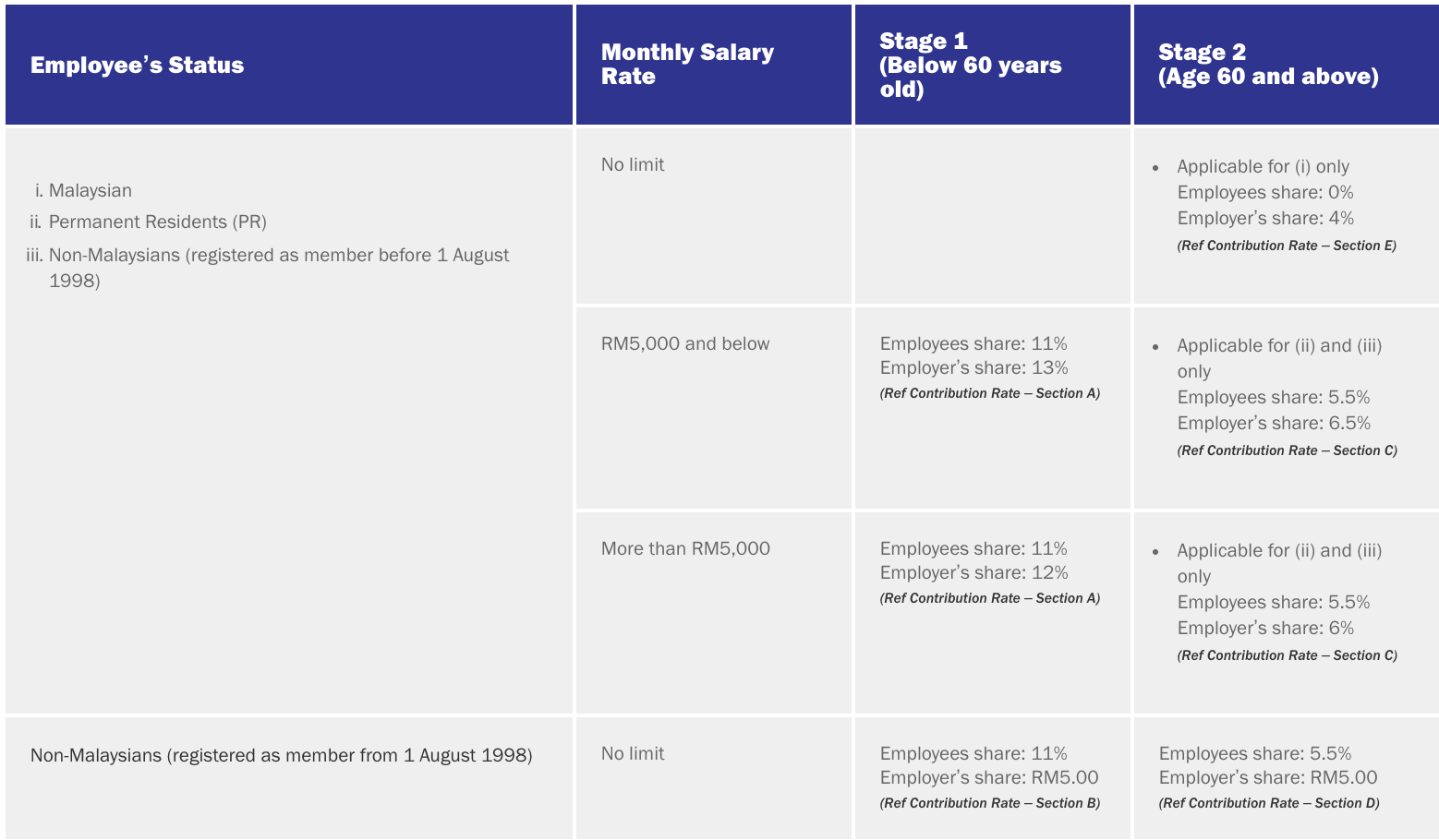

Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. Employee Pension Scheme EPS 833. This privilege is only for the first three years of employment.

Foreign workers are protected under SOCSO as well since January 2019. Besides we can get tax relief up to RM 6000 under Life insurance and EPF types. This year this rate of 850 shall benefit 6 crore subscribers.

Employees Provident Fund EPF 367. Contributions for a particular month will be eligible for dividend based on the last day of the contribution month until 31 December 2021. For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional.

This is another NPS benefit offered to the individuals. If you are interested to know the calculation of the EPF contribution formula you have came to the right place. I have given for offline transfer to do.

Moreover in the National Pension Scheme the contribution made by the employer and the employee are both applicable for the tax. The eye opener in the appended link is that a major part of the Employers contribution goes towards the EPS. Its because my previous employer PF was Trust and current employer is EPF.

National Labour Conference of Labour Ministers Labour Secretaries of states UTs - 25th 26th August 2022 - Tirupati Andhra Pradesh Top 75 establishments in terms of total number of e-nomination filed by women employees in the country Top 75 SSAs Top 7 Section Supervisors and Top 5 Accounts Officers who have. In early 2019 I registered myself for EPF i-Saraan previously known as 1Malaysia Retirement Savings Scheme or SP1M. EPF Contribution by Employee and Employer.

Employers EPF contribution rate. The contribution made towards the NPS scheme up to the maximum limit of Rs15 lakhs is eligible for tax exemption under Section 80C of the Income Tax Act. But through this plan they can do extra savings and which they can get only when they left their employer.

But this rate is revised every year. Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050. In 2019-18 members of EPFO earned an 865 of interest on their contributions towards the government saving scheme.

As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. The Central Government will also give equal matching contribution in his pension account. A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952.

Payment of 85 interest to around 6 crore EPF subscribers with the onset of the year 2021. The last declared EPF interest rate was for the year 2019-20 which stood at 850. Employers contribution will also be Rs.

Establishment of the Board. Presently the following three schemes are in operation. Percentage of contribution Employees Provident Fund.

EPF Contribution Rate 2022. Employees contribution is 12 of Rs. 6000 and it will go to the EPF.

Currently the interest rate on the deposit of EPF is 85 per annum. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. Malaysian age 60 and above.

The following is an example of Annual Dividend calculation based. Monetary payments that are subject to SOCSO contribution are. Revised EPF Interest Rate for 2019-20.

We can not transfer between Trust EPF. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. There are many advantages of EPF Self Contribution.

Through auto-debit facility from his her savings bank account Jan- Dhan account from the date of joining NPS-Traders till the age of 60 years as per the chart below. PART II THE BOARD AND THE INVESTMENT PANEL. You can also check the past changes in historical EPF interest rates.

From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Nowadays it has become mandatory for employers and employees to register theirs contribute to EPF. Theyll detect when receiving the EPF statutory contribution from the employer under statutory contribution and thus no longer on i-Saraan.

The employers contribution to EPF. Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. Step By Step Pay EPF Online.

Contribution by an employee Contribution towards EPF is deducted from the employees salary. Depending on the entity contributing towards EPF there are two components. At 85 this is the largest gap we are seeing when compared to the public provident fund PPF which is at just 71.

Click on the lower right button and back to the classic. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. With the EPF contribution rate of between 7 to 11 employee and 12 or 13.

As of now the EPF interest rate is 850 FY 2019-20. Although every person has their saving plans EPFO Pension Online Apply. EPF Interest Rate - Interest rate of EPF is reviewed every year after consultation with the Ministry of Finance by EPFOs Central Board of Trustees.

However this 12 is further subdivided into. I have recently joined a new organisation in January 2019. Hike in EPF Interest Rates 2018-19.

Employees EPF contribution rate.

What Is The Epf Contribution Rate Table Wisdom Jobs India

Epf A C Interest Calculation Components Example

New Epf Rules 2021 Latest Amendments To Epf Act

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Interest Rate From 1952 And Epfo

Epf A C Interest Calculation Components Example

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Epf Rules For Employer 2018 19 Registration And Contribution Planmoneytax

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf A C Interest Calculation Components Example

How Is Epf Contribution Calculated Goalsmapper Helpdesk

Employers Minimum Epf Contribution For Staff Aged 60 And Above Cut To 4 I Visit I Read I Learn

Download Employee Provident Fund Calculator Excel Template Exceldatapro

How To Calculate Interest On Your Epf Balance Mint

Epf Contribution Of Employee And Employer Rate Break Up